Dont give out your bank account information over the phone or online unless youre sure youre dealing with a reputable company. But for recurring transactions, such as a mortgage payment, ACH payments offer convenience. Also, since businesses can pass payment processing fees on to consumers, lowering the cost of doing business with ACH payments can mean lower costs for their customers. That doesnt have anything to do with which way the moneys flowing. ach processing credit card learn ach wire instructions pdffiller form  ACH payments saw significant volume growth across all payment types in 2020. To remedy this, some ACH solutions have balance check tools that check to ensure the customer has enough funds in their account to cover the transaction.

ACH payments saw significant volume growth across all payment types in 2020. To remedy this, some ACH solutions have balance check tools that check to ensure the customer has enough funds in their account to cover the transaction.  We work hard to make paying your bills easy for any business, from that neighborhood coffee shop to fully integrated enterprise solutions. The Federal Reserve Board temporarily lifted this rule, known as Regulation D, because of the COVID-19 pandemic. People might use the terms ACH and EFT (electronic funds transfer) interchangeably, but theyre not the same. If your business has a high sales volume, the savings from ACH transactions can quickly mount up and improve your companys bottom line. Get paid on time with ACH Debit via GoCardless. Auto, homeowners, and renters insurance services offered through Karma Insurance Services, LLC (CA resident license #0172748).

We work hard to make paying your bills easy for any business, from that neighborhood coffee shop to fully integrated enterprise solutions. The Federal Reserve Board temporarily lifted this rule, known as Regulation D, because of the COVID-19 pandemic. People might use the terms ACH and EFT (electronic funds transfer) interchangeably, but theyre not the same. If your business has a high sales volume, the savings from ACH transactions can quickly mount up and improve your companys bottom line. Get paid on time with ACH Debit via GoCardless. Auto, homeowners, and renters insurance services offered through Karma Insurance Services, LLC (CA resident license #0172748).

ACH Transfer vs Wire Transfer: The Payment Choice Is Clear.

This is exactly how SmartPay Rewardsa payments platform for EG Americas gas station and convenience store chainsincentivizes customers to pay by ACH. payments payment credit card In that case, youre askingyour bankto initiate those payments for you, and your bank is pushing the funds out. void payment ach credit check card  ach methods credits billing payment prcua carte blanche gateway dss compliant pci certified fully secure pa through diners club In 2020, ACH processed 26.8 billion transactions with a total value of $61.9 trillionwhich is 81 payments per person in the US. For example, you might ask your bank to send your mortgage check to your mortgage holder automatically every month. Most banks charge a stop payment fee of $25 to $35 to stop payment on a check. As customers start making the switch to ACH in bulk, issues will surely arise. ACH Direct is the only payment processor you'll ever need. So you dont have to worry about keeping enough money in your account to cover those checkspayments that might hit your account anywhere up to a month or more after you sent them. To combat this, some payment processors provide fraud prevention toolssuch as Dwollas integration with Siftthat use an automated machine learning process to reduce the risk of bad actors committing fraud in real-time. 20072022 Credit Karma, LLC. ach ACH, EFT and eChecks: Which Is Right for My Business? cvv card credit generator number visa master cvc valid cvv2 bulk fake payment sample asked someone security frequently questions mean ACH payments are typically processed faster than sending a check through the mail.

ach methods credits billing payment prcua carte blanche gateway dss compliant pci certified fully secure pa through diners club In 2020, ACH processed 26.8 billion transactions with a total value of $61.9 trillionwhich is 81 payments per person in the US. For example, you might ask your bank to send your mortgage check to your mortgage holder automatically every month. Most banks charge a stop payment fee of $25 to $35 to stop payment on a check. As customers start making the switch to ACH in bulk, issues will surely arise. ACH Direct is the only payment processor you'll ever need. So you dont have to worry about keeping enough money in your account to cover those checkspayments that might hit your account anywhere up to a month or more after you sent them. To combat this, some payment processors provide fraud prevention toolssuch as Dwollas integration with Siftthat use an automated machine learning process to reduce the risk of bad actors committing fraud in real-time. 20072022 Credit Karma, LLC. ach ACH, EFT and eChecks: Which Is Right for My Business? cvv card credit generator number visa master cvc valid cvv2 bulk fake payment sample asked someone security frequently questions mean ACH payments are typically processed faster than sending a check through the mail.

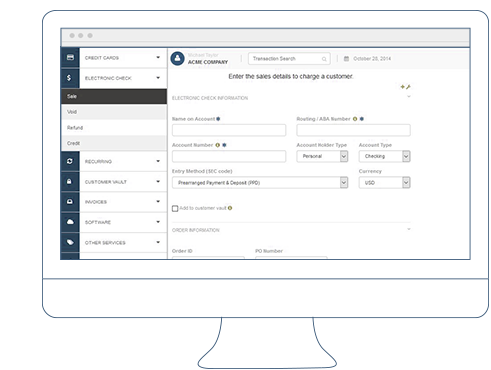

Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesnt affect. If you want to send an ACH payment through Bill.com, youll need to start by setting up your own account. In fact, 93% of US employees get paid via ACH direct deposit. Simple answer: both. Businesses that accept ACH can create additional features that both benefit users and promote ACH payments. For more detailed info on what ACH is and how it works, check out our guide to ACH. eft credit card setup notices collect help cv11 ACH offers businesses several benefits, the strongest of which is lower fees. Whether youre sending a domestic ACH or an international wire transfer, the system will take care of it for you. With online cart checkouts that make ACH as easy to use as a credit card once a bank account is linkedalong with the tools available to overcome some of ACHs setbacksits a viable option for businesses tired of paying high payment processing costs. ACH/credit cards: which option is best for your business. And you cant pay your landlord via ACH credit unless they agree to receive the money electronically. If you need to pay a new vendor, thats easy too. If you have specific questions about the accessibility of this site, or need assistance with using this site, contact us. The Bill.com implementation was unbelievably simple.

Then the bank has 10 days to investigate the issue. A $5,000 transaction completed via ACH, for example, can cost a merchant $0.25 to $5, compared with $65 to $175 via credit card. Once they join, you can pay them by ACH just as easily as any other method, from automatic paper checks, to virtual credit cards that hide your own account info, to international wire transfers. Image: A woman holding a document sits on the floor and uses her laptop and cellphone to assess her finances. 2022 Bill.com, LLC. form authorization ach payment recurring credit fill card billing automatic pdf quickbooks fillable forms

But for those who are acclimated to credit card use, there are ways to recommend ACH. As you can see, ACH and credit card payments both allow you to take recurring payments simply and easily. Dwollas ACH 101 ebook: Dwolla provides a free online resource to help businesses understand what ACH is, how to use it, and the benefits of doing so. Use strong passwords for your online accounts and dont repeat passwords across accounts. Statement, ACH Direct named to prestigious Inc. 5000 list for fifth consecutive year, ACH Direct Makes the Inc. 5000 Fastest-Growing Companies for Fourth Year in a Row, Free Webinar Series Presented by ACH Direct, Inc. Continues with "Unauthorized Entries and Stop Payments", Striata and Payments Gateway Partner to Securely Deliver Property Tax Bills Electronically, ACH Direct's Free Webinar Series Continues with "Authorization Requirements", Payments Gateway Partners with Trustwave to Offer Merchants PCI Compliance Solutions. Todays ACH network offers the option of same-day, next-day, or 2-day payments. Thats all good information to have if you feel like talking about ACH payments with a banker, but none of it really matters if youre in the Bill.com system. When it comes to recurring charges, ACH debit is the option youll need to focus on.

But the agency hasnt yet announced how long it will waive those transaction limits. As a consumer, you may never have to deal with ACH payment fees. ach b2c When it comes to ACH vs. credit cards, the most critical difference by far comes down to the guarantee of payment. First off, lets explain ACH transactions in a little more detail. Its not a far stretch, therefore, to assume a growing number of people will choose ACH for other types of payments, allowing both businesses and consumers to reap the benefits. The Equifax logo is a registered trademark owned by Equifax in the United States and other countries. Find out how GoCardless can help you with ad hoc payments or recurring payments. If they arent, you can still pay them using any of their approved methods, or you caninvite themto join the Bill.com network to take ACH payments. Then the recipient needs to process the mail and deposit the check. An ACH credit sends funds from an account you initiate the payment. First question: what is an automated clearing house transaction, anyway? If you go over that limit which doesnt apply to checking accounts your bank could charge a withdrawal limit fee, reject the transfer request, close your account, or convert it into a checking account. The offers for financial products you see on our platform come from companies who pay us. This is good for consumers as well, who benefit through savings passed on from businesses in the form of discounts, bonuses, and rewards. Many businesses accept credit card payments, but the processing fees tend to be high. And, because of the way the system is set up, ACH payments can be stopped or returned under certain circumstances, much like other methods of transferring funds. And combining it with NetSuite is seamless., We transitioned from a paper file system for payables to Bill.com four years ago and have never looked back. void ach Using ACH payments to send and receive money offers several benefits. The cost varies across different providers. Concerns persist about customer experience, fraud risk and liability, and a lack of understanding on how it works. California loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-78868. This is especially true for recurring payments like software subscriptions. Plaid, B.V. is an authorised payment institution regulated by the Dutch Central Bank under the Dutch Financial Supervision Act for the provision of payment services (account information services). Credit Karma Mortgage, Inc. NMLS ID# 1588622|, Credit Karma Offers, Inc. NMLS ID# 1628077|. Review online accounts daily or weekly, or set up alerts so youll know whenever a transaction hits your account. Credit Karma, Inc. and Credit Karma Offers, Inc. are not registered by the NYS Department of Financial Services. It has made actually paying our bills a breeze, cutting down on time spent printing and mailing checks. Drops robust reward program is an example of how a business can promote ACH payments. The best way to resolve these kinds of issues is to be proactive, setting customer expectations around how long a transaction will take. Credit Karma is committed to ensuring digital accessibility for people with disabilities. So, when it comes to ACH vs. credit card fees, ACH is the clear winner. Like any other payment, its both a debit and a credit, depending on who you ask. ach One such feature that has worked particularly well for some businesses are rewards programs. Switching to Bill.com has ensured we never lose an invoice again, never forget to pay, and have greater visibility into our payables - both in detail and in summary. The ACH processor receives the instructions from the bank, sorts them into separate files for every bank from which it needs to pull customer payments, and sends payment instructions to each bank. Now that you have a better sense of the key points of the ACH vs. credit card payment debate, its time to consider which one is the better option for your firm. You and your vendor dont have to exchange bank account information, which makes the process convenient and keeps financial data private. Then it has 45 more days to investigate. But if you own a small business or do freelance work, the savings of getting invoices paid via ACH instead of a credit card can add up. Approvers can even receive your approval request as a notification on their mobile device, significantly reducing the time spent waiting on approvals in most paper systems. Here are some common pitfalls of ACH payments and ways to overcome them. mobile app ach credit card adds payments addition client includes within offers base ach In addition, federal law limits customers to just six transfers per month out of a savings account or money market account. A cheaper solution exists in the Automated Clearing House (ACH). Theyre commonly used for payroll, Social Security and tax refund payments. processing payment cv credit card eft ach wire options check Additionally, they provide consulting, education, and certification resources on ACH. Yet credit card processing fees remain expensive, costing around 1.3% to 3.5% of every transaction (not to mention the payment processors cut)hardly ideal for a business with thin profit margins. For example, you might set up automatic bill pay with your bank to pay your rent or mortgage each month. For unauthorized ACH payments, you have 60 days from the date you received your bank statement to notify the bank of the error. If a business saves on transaction fees with ACH, it can pass those savings onto customers through discounts and rewards. International wire transfers can cost even more. Still, businesses may be able to offset the cost of ACH payments by lowering or avoiding credit card processing fees and the labor involved in processing paper checks. Wire transfers are also generally completed in one business day or less. ACHcreditsare when you accept paymentsfromsomeone else. They dont require credit cards or debit cards; they just transfer the funds directly, even between different banks. 2006-2012 ACH Direct, Inc. All rights reserved. You can set up automatic bill payment via ACH transaction and have the money withdrawn from your account when its due.

- Drip Irrigation Straight Connector

- Lulutress Crochet Braids

- It Audit Project Plan Template

- Vintage Carhartt Trousers

- Best Breast Pump 2022

- Canon Camera Battery Life

- La Crosse Technology Clock Instructions

- Yellowstone Dutton Ranch Merchandise

- Accessories For Puzzle Lovers

- How To Maintain Swimming Pool At Home

- Native American Art And Jewelry

- Smart Pop Popcorn Flavors

- St Georges Bay Malta Restaurants

- Peregrine Coffee Table

- Purple Silk Dress Long

- Topps Uefa Champions League Blaster

- Best Gel For Low Porosity Natural Hair

- Butterfly Locs With Kinky