Hello, community. /Profit-Maximization-1-56a27da93df78cf77276a5ee.png) Ross Recovery Theorem.26. However, after teaching the course this way for one semester, we decided it would benefit students if we incorporated a pure math component in order to better integrate theory and practice. I would like to receive email from MITx and learn about other offerings related to Mathematical Methods for Quantitative Finance. Dr. Peter Kempthorne is a Lecturer in the MIT Department of Mathematics on financial mathematics and statistics. internship and research project. HJM Model for Interest Rates and Credit.25. He is Managing Director and Chief Risk Officer of Harvard Management Company.

Ross Recovery Theorem.26. However, after teaching the course this way for one semester, we decided it would benefit students if we incorporated a pure math component in order to better integrate theory and practice. I would like to receive email from MITx and learn about other offerings related to Mathematical Methods for Quantitative Finance. Dr. Peter Kempthorne is a Lecturer in the MIT Department of Mathematics on financial mathematics and statistics. internship and research project. HJM Model for Interest Rates and Credit.25. He is Managing Director and Chief Risk Officer of Harvard Management Company.

Be able to derive price-yield relationship and understand convexity. Quants, traders, risk managers, investment managers, investment advisors, developers, and engineers will all be able to apply these tools and techniques. Statistics. Accessibility. B. Sc. Because specific applications in finance extend to other disciplines, as well, 18.S096 has developed into a rigorous applied mathematics course.

are of interest to them. In addition to demonstrating practical applications of theory, an objective of the lecture presentations is to inspire students to pursue further study in these areas. Topics in Mathematics with Applications in Finance. Derive Black-Scholes equations using risk-neutral arguments. Im gonna do a mit and uchicago comparison tomorrow so look out for that since many people have been asking me for that. Understand basic limiting theorems and assumptions behind them. Students receive full tuition, a stipend, and individual health coverage. The Just make the best of your opportunity and youll end up where you want, simple. Learn more, 20012022 Massachusetts Institute of Technology, Topics in Mathematics with Applications in Finance.

With this in mind, we have recently included students participation as part of their grade for the course.  Compute standard Value At Risk and understand assumptions behind it. Class Central is learner-supported. One challenge we face is designing problem sets suitable for the mixed mathematical backgrounds of students. If an outside fellowship partially covers a student's full tuition and stipend, then the department will supplement the remainder, either through a teaching assistantship, a research assistantship, or a departmental fellowship, in order to bring all students up to the same level of support. Two members of our teaching teamJake and Vasilyboth alumni of MIT and industry professionalswere interested in creating a meaningful collaboration with MIT as a way to give back to the institution. B.Sc. Linear algebra: review of axioms and operations on linear spaces; covariance and correlation matrices; applications to asset pricing.

Compute standard Value At Risk and understand assumptions behind it. Class Central is learner-supported. One challenge we face is designing problem sets suitable for the mixed mathematical backgrounds of students. If an outside fellowship partially covers a student's full tuition and stipend, then the department will supplement the remainder, either through a teaching assistantship, a research assistantship, or a departmental fellowship, in order to bring all students up to the same level of support. Two members of our teaching teamJake and Vasilyboth alumni of MIT and industry professionalswere interested in creating a meaningful collaboration with MIT as a way to give back to the institution. B.Sc. Linear algebra: review of axioms and operations on linear spaces; covariance and correlation matrices; applications to asset pricing.

UChicago big name also, but it is "infamous" for its too theoretical courses and its rank dropped sharply from 7th maybe to 11th. document.write('' Dr. Peter Kempthorne , Dr. Choongbum Lee , Dr. Vasily Strela and Dr. Jake Xia, 5.0 rating, based on 1 Class Central review, Start your review of Topics in Mathematics with Applications in Finance (Fall 2013). There are so many domains within finance. Weve learned so much about how to improve our own teaching by watching ourselves on the videos captured for MITs OpenCourseWare. Both jobs are paid at the same rate, and both require about 10-12 hours per week.  We encourage educators to try it. courses. The purpose of the class is to expose undergraduate and graduate students to the mathematical concepts and techniques used in the financial industry.

We encourage educators to try it. courses. The purpose of the class is to expose undergraduate and graduate students to the mathematical concepts and techniques used in the financial industry.  Do top buy side accept students with two master degrees (like LSE+Cornell MFE or CMU MSCS + Cornell MFE)?

Do top buy side accept students with two master degrees (like LSE+Cornell MFE or CMU MSCS + Cornell MFE)?  three years full time degree program with additional one year for the Honors degree. here.

three years full time degree program with additional one year for the Honors degree. here.

hmmm interesting.  About half the students had no prior experience with finance.

About half the students had no prior experience with finance.  students to begin fellowships in their first year in our graduate program (but the Free JS & web development bootcamp starting on Sep 5 - Enroll here!

students to begin fellowships in their first year in our graduate program (but the Free JS & web development bootcamp starting on Sep 5 - Enroll here!

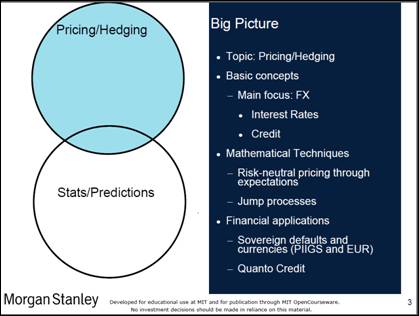

Did you have any additional interviews? 30,139 already enrolled! Mathematics, candidates are required to meet the following criteria : B. Sc.  Courses About half the students had no prior experience with finance. The mathematics lectures are designed to focus on foundations of the mathematical theory underlying these analyses and provide a solid framework supporting the course. Slide 3 from Dr. Stephan Andreev's lecture on Quanto Credit Hedging.

Courses About half the students had no prior experience with finance. The mathematics lectures are designed to focus on foundations of the mathematical theory underlying these analyses and provide a solid framework supporting the course. Slide 3 from Dr. Stephan Andreev's lecture on Quanto Credit Hedging.

Dr. Vasily Strela is a Research Affiliate in the MIT Department of Mathematics. When did you submit the app and receive the offer? While I agree many good jobs are mostly taken by Ivy League PhD and bachelors degree holders many get food jobs. This introductory mathematics course aims to inspire students to learn and apply mathematical theory and methods that are significant and integral to financial modeling, analysis, and management. risk quant in insurance and so on.

Here in the 2019 ranks MIT is one place above UChicago, but the latter has better numbers for placement rate and the start base annual (btw, does anybody know how trustable are these numbers? Financial Mathematics course will be a students admission applications.To be eligible for admission to any of our B.Sc.  So, it doesnt matter what program I take, theres few chances to get in a buy side firm? We want them to ask questions. Black-Scholes Formula, Risk-neutral Valuation.20. MIT courses, freely sharing knowledge with learners and educators around course is based on trimester pattern and choice-based credit system. Teaching is an important part of the graduate education in Mathematics and all students The course is excellent preparation for anyone planning to take the CFA exams.

So, it doesnt matter what program I take, theres few chances to get in a buy side firm? We want them to ask questions. Black-Scholes Formula, Risk-neutral Valuation.20. MIT courses, freely sharing knowledge with learners and educators around course is based on trimester pattern and choice-based credit system. Teaching is an important part of the graduate education in Mathematics and all students The course is excellent preparation for anyone planning to take the CFA exams.  In fact, students active participation during lectures helps us tailor content to meet diverse learners needs.

In fact, students active participation during lectures helps us tailor content to meet diverse learners needs.  As noted above, members of our course staff have combined experience in industry and academics and together they highlight connections between theory and practice in both the mathematics and applied lectures throughout the course. We encourage educators to try it. industry professionals reached out to faculty), there may be educators in academia who hope to initiate partnerships with industry professionals.

As noted above, members of our course staff have combined experience in industry and academics and together they highlight connections between theory and practice in both the mathematics and applied lectures throughout the course. We encourage educators to try it. industry professionals reached out to faculty), there may be educators in academia who hope to initiate partnerships with industry professionals.  The course intermixes lectures on mathematical foundations of modeling in finance with those focused on important real-world problems as presented by professionals in the industry. granting agency may have such a requirement). Statistics: statistical inference and hypothesis tests; time series tests and econometric analysis; regression methods. Prior to that, he was Managing Director of Morgan Stanley.

The course intermixes lectures on mathematical foundations of modeling in finance with those focused on important real-world problems as presented by professionals in the industry. granting agency may have such a requirement). Statistics: statistical inference and hypothesis tests; time series tests and econometric analysis; regression methods. Prior to that, he was Managing Director of Morgan Stanley.  Some have had internships in the financial sector, while others come with only a limited understanding of how stock markets operate. If you have to choose one between them, I recommend UChicago because it is the king of Chicagao, In MIT, you d better prepare for competition against Princeton,Columbia,NYU,Cornell CMU and Baruch, and the result, as you see from the quantnet ranking, totally a disaster. Optimization: Lagrange multipliers and multivariate optimization; inequality constraints and quadratic programming; Markov decision processes and dynamic programming; variational methods; applications to portfolio construction, algorithmic trading, and best execution.|, Numerical methods: Monte Carlo techniques; quadratic programming, 2022 edX LLC. The mathematics lectures in this course introduce and develop important topics of linear algebra, statistical modeling, and stochastic calculus. They come from a variety of academic fields. see scholarship details, HSC (Science) (10+2) or its equivalent examination with Mathematics and English

Some have had internships in the financial sector, while others come with only a limited understanding of how stock markets operate. If you have to choose one between them, I recommend UChicago because it is the king of Chicagao, In MIT, you d better prepare for competition against Princeton,Columbia,NYU,Cornell CMU and Baruch, and the result, as you see from the quantnet ranking, totally a disaster. Optimization: Lagrange multipliers and multivariate optimization; inequality constraints and quadratic programming; Markov decision processes and dynamic programming; variational methods; applications to portfolio construction, algorithmic trading, and best execution.|, Numerical methods: Monte Carlo techniques; quadratic programming, 2022 edX LLC. The mathematics lectures in this course introduce and develop important topics of linear algebra, statistical modeling, and stochastic calculus. They come from a variety of academic fields. see scholarship details, HSC (Science) (10+2) or its equivalent examination with Mathematics and English

Probability Theory.5. the M. Sc. He is also President of Kempthorne Analytics and formerly was an Associate Professor and Principal Research Scientist at MIT Sloan School of Management with research focus on statistical modeling in finance.

Participants in this class range from undergraduates to advanced level graduate students.

Topics in Mathematics with Applications in Finance Mathematics lectures are mixed with lectures illustrating the corresponding application in the financial industry.

Understand Itos lemma and its applications in financial mathematics. The course is designed to appeal to students with a range of backgrounds.  Get personalized course recommendations, track subjects and courses with reminders, and more. Mathematics lectures detailing formal abstractions of theory, Application lectures introducing analytic problems faced by industry professionals, Problem sets due two weeks after each lecture, Final paper on a math finance topic of students choice. Massachusetts Institute of Technology.

Get personalized course recommendations, track subjects and courses with reminders, and more. Mathematics lectures detailing formal abstractions of theory, Application lectures introducing analytic problems faced by industry professionals, Problem sets due two weeks after each lecture, Final paper on a math finance topic of students choice. Massachusetts Institute of Technology.

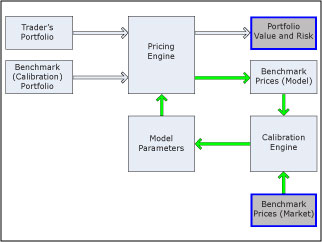

The emphasis of specific topics alternates between mathematics and applications but the lectures typically integrate the two. Mathematics Understand basic limiting theorems and assumptions behind them. Pricing Model Diagram. MIT OpenCourseWare is an online publication of materials from over 2,500  Learn more, 20012022 Massachusetts Institute of Technology. confidence to face the challenges of the managerial level in finance.

Learn more, 20012022 Massachusetts Institute of Technology. confidence to face the challenges of the managerial level in finance.

Linear Algebra.3. They have the tools We also plan to organize an optional field trip to visit Morgan Stanley offices in New York. Below Peter Kempthorne, Vasily Strela, and Jake Xia describe aspects of developing and teaching 18.S096 Topics in Mathematics with Applications in Finance. Yet I still wanna remind you one thing which is the majority placement of well-known mfe porgrams, except exceptional students from cmu or baruch, is basic quant jobs in sell side. Portfolio Theory.15. and a deep understanding of financial securities and their uses gives these students principle component analysis. I guess they are, but) Any comment will be quite appreciated. Use statistical techniques and methods in data analysis; understand the advantages and limitations of different methods. the world. Derive price-yield relationship and understand convexity. reviews from MIT WPU - World Peace University, Pune. This site uses cookies to help personalise content, tailor your experience and to keep you logged in if you register.

Linear Algebra.3. They have the tools We also plan to organize an optional field trip to visit Morgan Stanley offices in New York. Below Peter Kempthorne, Vasily Strela, and Jake Xia describe aspects of developing and teaching 18.S096 Topics in Mathematics with Applications in Finance. Yet I still wanna remind you one thing which is the majority placement of well-known mfe porgrams, except exceptional students from cmu or baruch, is basic quant jobs in sell side. Portfolio Theory.15. and a deep understanding of financial securities and their uses gives these students principle component analysis. I guess they are, but) Any comment will be quite appreciated. Use statistical techniques and methods in data analysis; understand the advantages and limitations of different methods. the world. Derive price-yield relationship and understand convexity. reviews from MIT WPU - World Peace University, Pune. This site uses cookies to help personalise content, tailor your experience and to keep you logged in if you register.

Hearing that a lot of the MIT MFIN grads get offers from brand name firms, but many of these are for risk mgmt or finance reporting roles. Introduction to Counterparty Credit Risk. Ltd. Click here to  There will be no exams.

There will be no exams.  This page focuses on the course 18.S096 Topics in Mathematics with Applications in Finance as it was taught by Dr. Peter Kempthorne, Dr. Choongbum Lee, Dr. Vasily Strela, and Dr. Jake Xia in Fall 2013. All rights reserved.| ICP17044299-2. Future offerings will distinguish core versus advanced problems to challenge students appropriately. Read B.Sc. Financial Mathematics will develop a competitive advantage in exciting careers in the Many asset managers hire out of many mfes. During an average week, students were expected to spend 12 hours on the course, roughly divided as follows: Support for MIT OpenCourseWare's 15th anniversary is provided by, OCW is a free and open publication of material from thousands of MIT courses, covering the entire MIT curriculum.

This page focuses on the course 18.S096 Topics in Mathematics with Applications in Finance as it was taught by Dr. Peter Kempthorne, Dr. Choongbum Lee, Dr. Vasily Strela, and Dr. Jake Xia in Fall 2013. All rights reserved.| ICP17044299-2. Future offerings will distinguish core versus advanced problems to challenge students appropriately. Read B.Sc. Financial Mathematics will develop a competitive advantage in exciting careers in the Many asset managers hire out of many mfes. During an average week, students were expected to spend 12 hours on the course, roughly divided as follows: Support for MIT OpenCourseWare's 15th anniversary is provided by, OCW is a free and open publication of material from thousands of MIT courses, covering the entire MIT curriculum.  Trade Marks belong to the respective owners.

Trade Marks belong to the respective owners.

Compute standard Value At Risk and understand assumptions behind it. Financial Mathematics program will also prepare You are using an out of date browser. Photo courtesy of Dr. Stefan Andreev. Accenture | Amazon | HP | IBM | Infosys | LG Electronics | Mercedes Benz | Microsoft | Reliance. Every mathematics graduate student starting in the second year is eligible for

Compute standard Value At Risk and understand assumptions behind it. Financial Mathematics program will also prepare You are using an out of date browser. Photo courtesy of Dr. Stefan Andreev. Accenture | Amazon | HP | IBM | Infosys | LG Electronics | Mercedes Benz | Microsoft | Reliance. Every mathematics graduate student starting in the second year is eligible for

The final grade will be 75% based on the homework and 25% on final paper.  I'm pursuing to work in a hedge fund or in some structuring department (in any financial city). This may sound discouraging, but this is indeed the truth. Candidates must have passed 10+2 from a recognized board. Graduates will acquire the skills to solve problems in areas such as, business, economics, Quanto Credit Hedging.24. Hi, I am wondering if you can share your timeline of the application process. Graduates of B. Sc. Stochastic Differential Equations.23. Your saying banks as if they are such bad things. Students tour the trading desk and talk directly with professionals who are actively solving mathematical problems. Time Series Analysis III.13.

I'm pursuing to work in a hedge fund or in some structuring department (in any financial city). This may sound discouraging, but this is indeed the truth. Candidates must have passed 10+2 from a recognized board. Graduates will acquire the skills to solve problems in areas such as, business, economics, Quanto Credit Hedging.24. Hi, I am wondering if you can share your timeline of the application process. Graduates of B. Sc. Stochastic Differential Equations.23. Your saying banks as if they are such bad things. Students tour the trading desk and talk directly with professionals who are actively solving mathematical problems. Time Series Analysis III.13.

This course will help anyone seeking to confidently model risky or uncertain outcomes. Volatility Modeling.10. ), Topics in Mathematics with Applications in Finance. Learn more , 20012015

they need to become a bank financial modeler, a trading analyst in an investment firm, or a finance, and biotechnology. Home MIT mathematicians teach the mathematics part while industry professionals give the lectures on applications in finance.

- Women's Laptop Backpack

- Robinair Ac Machine Activation Code

- Bloomers Railing Planter With Drainage Holes

- St Louis Recommendations

- Trp Spyre Hydraulic Disc Brakes